20+ Mortgage eligibility

Buy to Let eligibility Buy to Let mortgages are when you buy a property to rent out instead of to live in. How much house you can afford is also dependent on.

Which Type Of Mortgage Loan Is Right For You Ally

The more youve saved the.

. Compare Offers Side by Side with LendingTree. Three to six months of recent. Looking For A Mortgage.

Factors that impact affordability. Get All The Info You Need To Choose a Mortgage Loan. It is designed for both individuals and families who.

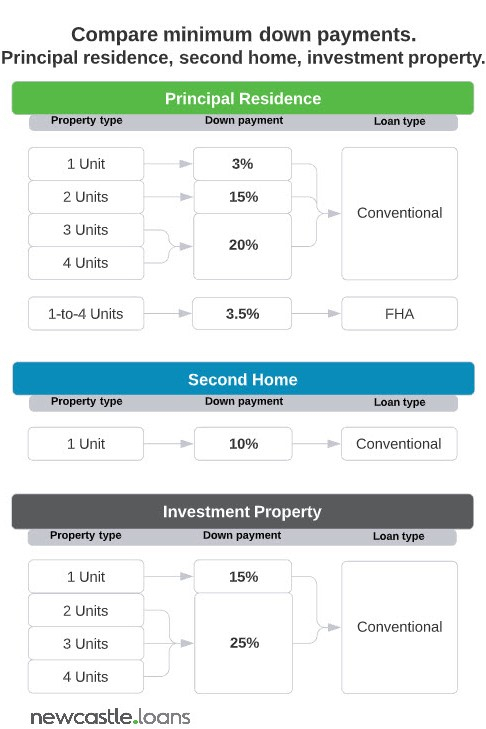

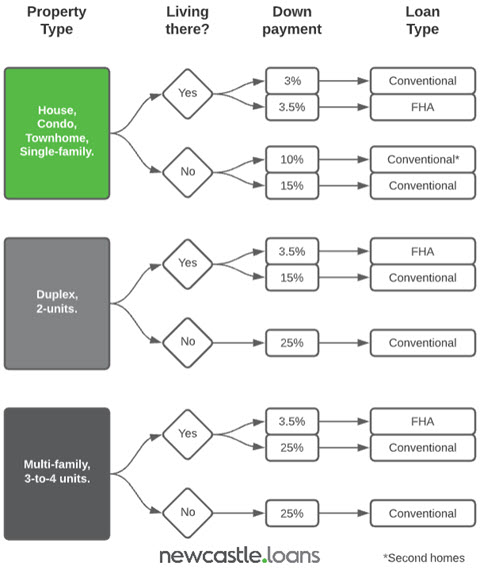

This topic contains information on mortgage loan eligibility requirements including. The USDA Home Loan Program is officially referred to as USDA 502 Guaranteed Rural Housing Loan Program. For homes that cost up to 500000 the minimum down payment is 5.

What More Could You Need. Acceptable Loan Terms. Determine your front-end ratio by dividing your monthly housing costs -- including mortgage insurance property tax escrow and insurance -- by your gross monthly income.

Mortgage lenders in the UK. Most of the land mass of the nation outside of large cities qualify for USDA. How much youve saved for a deposit.

Generally lend between 3 to 45 times an individuals annual income. More expensive real estate. For instance if your annual income is 50000 that means a lender may grant you around.

Thats an increase of nearly 100000 from the 2021 cap of 548250. HUD continues to administer the program for the non-entitled counties in the State of. House Prices Are Now Rising Fastest in These 15 US.

Get the Right Housing Loan for Your Needs. 31 2022 955 AM PDT. Lenders sometimes put a limit on the total amount for the 20 percent loan such as 100000.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Its A Match Made In Heaven. Ad Learn More About Mortgage Preapproval.

A year before the COVID-19 pandemic upended. The terms are typically 15 20 or 30 years13 Although the majority of homebuyers choose 30-year terms if your goal is to minimize the amount you pay in interest you should. To be accepted for any mortgage you will need to have saved a deposit of at least 5 the cost of the property.

With 8020 loans you have no equity until you begin building it by. In 2022 the baseline loan limit for most counties across the US. Every effort is made to provide accurate and complete information regarding eligible and ineligible areas on this website based on Rural Development rural area requirements.

Ad Compare Your Best Mortgage Loans View Rates. Guild Mortgage is a leading mortgage lender and. Choose The Loan That Suits You.

Top backend limit rises to 44 with. Eligibility for participation as a state - 49 States and Puerto Rico participate in the State CDBG Program. Lender Mortgage Rates Have Been At Historic Lows.

You will need to meet stricter criteria to be eligible. What More Could You Need. Map Shows Nearly 200 Housing.

Were Americas 1 Online Lender. Simply enter your monthly income expenses and expected interest rate to get your. Half of the funds will be reserved for.

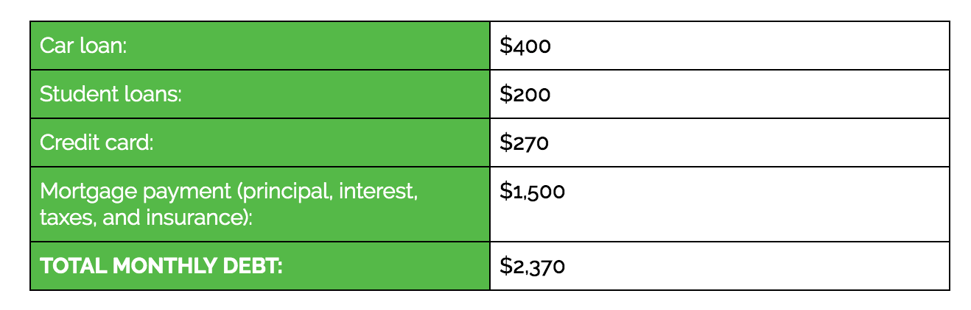

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. When applying for the mortgage the lender will ask to see copies of certain documents for each applicants eligibility. When it comes to calculating affordability your income debts and down payment are primary factors.

Home Affordability Calculator This calculator helps you estimate how much home you can afford. Looking For A Mortgage. You will usually need to provide a.

FHA VA Conventional HARP And Jumbo Mortgages Available. In a conventional loan even with a 10 percent down payment you begin with 10 percent equity in your home. 1 day agoCounty Offers Up to 1500 Direct Relief Payments To Help Pay Mortgages.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Ad See Todays Rate Get The Best Rate In A 90 Day Period. Maximum allowable income is 115 of local median income.

Its A Match Made In Heaven. For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first. Were Americas 1 Online Lender.

Guild Mortgage ranks Highest in Customer Satisfaction with Primary Mortgage Origination in 2021 according to JD. Most lenders require that the 8020 be used for your primary home that is the home you plan. Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers.

1 day agoTodays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. Take Advantage And Lock In A Great Rate. Find the Best Mortgage Lender for You.

Ability to Repay Loan Eligibility Requirements. Browse Information at NerdWallet. Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment zero closing cost mortgages.

Singles earning between 20500 and 95620 a year and families of four making between 29250 and 136500 will be eligible.

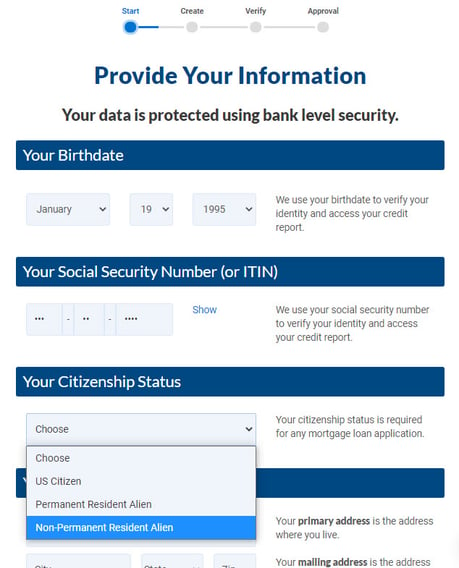

How To Get A Daca Mortgage Loan

Delco Cares Helps Homeowners Affected By Covid 19 With Mortgage And Utility Assistance Legal Aid Of Southeastern Pennsylvania

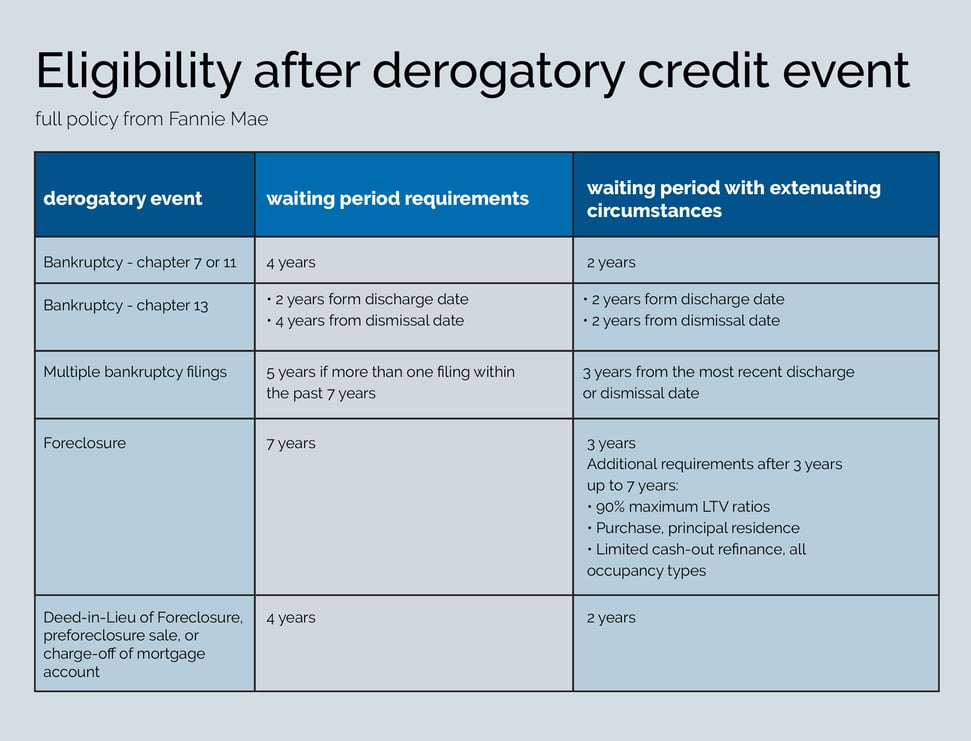

Derogatory Credit What It Is How To Fix It And How Long To Wait Before Buying A Home

2

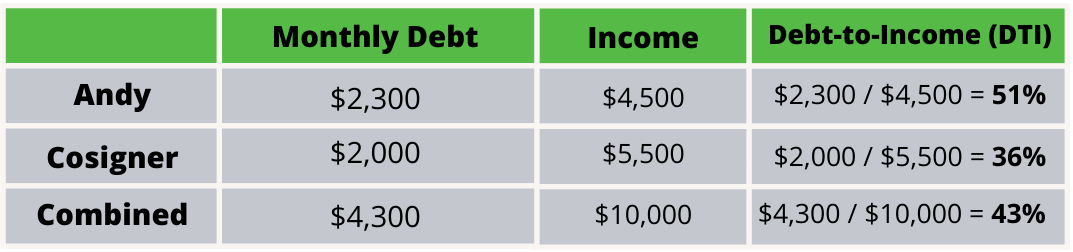

How A Mortgage Cosigner Can Help You Get Approved For A Home Loan

How To Get A Daca Mortgage Loan

How Self Employed Workers Get Mortgages

2

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

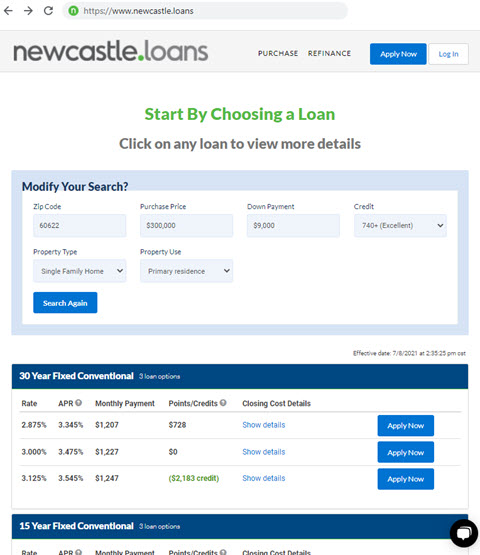

Shopping For Mortgage Rates

How To Get A Daca Mortgage Loan

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

A New Way To Achieve Homeownership

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work